Did you know that over 90% of home buyers never compare 2 or more lenders to see if they can get a better deal. Most home owners loose thousands of dollars simply because they never shop around for their mortgage. In this guide you will learn the basics of “how to shop for a mortgage“.

Getting a great deal on a mortgage is a lot easier then you think. It involves knowing your credit score, knowing some of the basics, and picking up the phone. That’s about it.

What to know.

A few key things to know about before you pick up the phone.

- Your Credit Score.

- Fees the Lender Controls and charges.

- Rates and Cost of Rates.

- Lender Profit Margins.

- Pick up the phone and call.

- Compare your Rate Quotes.

Your Credit Score.

You need to know your credit score when comparing lenders. Lenders will use your score to pull up “pricing” which is what different interest rates are for you and the rate is based on the credit score.

The easiest way to obtain your credit score is to create an account on Mint or Kredit Carma. These online websites will show you what your credit score it. The score you see on these sites is usually about 20 points higher then the Mortgage Credit score.

The other way to get your credit score is to go directly to the credit bureaus. Equifax, Experian and Transunion. Each has a website that you can go to and see your credit.

Fees the Lender Controls.

There are three basic fees that the lender controls. It is good to know that all of these fees are simply a way for the lender to get more money from you. All three of these lender fees all go to the lender and in essence can be added together to come up with the “total cost” of the interest rate you are being quoted. When you are being quoted a rate from a lender you need to add all three of these costs together and treat them as one cost, the lenders cost for the interest rate.

Loan Origination: This is a fee charged to originate the loan. If this is charged it can be upwards of 1% of the loan amount. If you buy a $400,000 home this fee could be upwards of $4,000 or more.

Loan Discount Points: This is a fee to “pre pay” additional profit to the lender and in doing so you get a slightly lower rate. The discount fee can be upwards of 1% or more of the loan amount. If you buy a $400,000 home this fee could be upwards of $4,000 or more.

Processing Fee / Underwriting Fee: This fee is usually $500 for Processing and $1,000 for underwriting and is simply a way for the lender to make more money on a loan and break it out so that it seems to make more sense to you.

Rates.

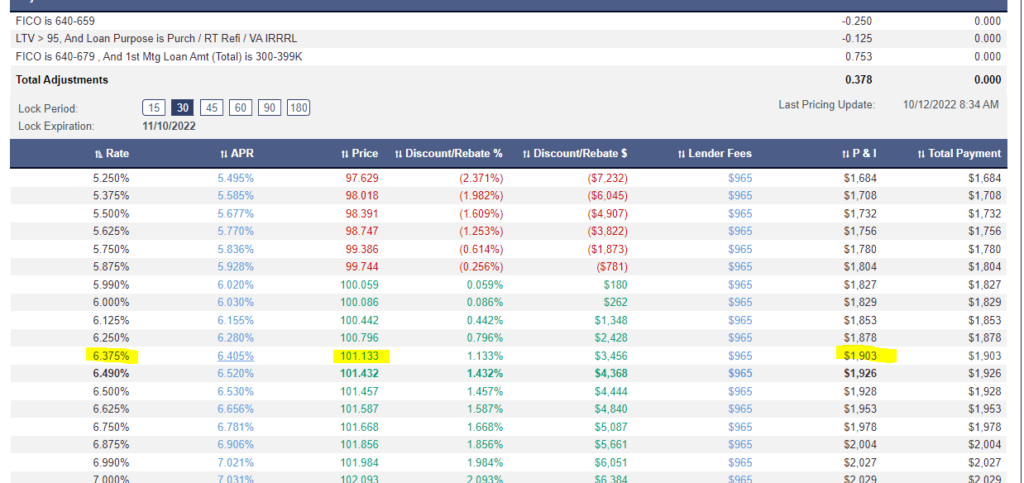

Each interest rate has a certain amount of cash that is either being paid to the lender or that the lender has to pay to secure that rate to you. If you look at the image below you will see a Price Column. If the number in this Colum is green the lender is making money on the interest rate and if it is red it is costing the lender money to secure that rate. This money is being made or costing the lender without you knowing about it and is considered the “back end” costs and cash flow the lender receives after closing.

If you look at this image you can see that the highlighted numbers show that If you are quoted an interest rate of 6.375% that the lender would make 1.1333% (101.133 is 1.133% of the loan amount) as additional profit on the loan. This additional profit is paid directly to the lender without you knowing.

As you look at this image you can also see that the Higher your interest rate is the more money the lender is paid after closing.

When the lender is quoting you an interest rate they are looking at a sheet like this and deciding how much money they want to make on you. Some times the lender will charge additional fees, Origination Fee, Discounts Points, or Processing and Underwriting fees to make more money on the loan.

It is up to you to “negotiate” for a better rate, this is usually easily done by asking the lender for the “Rate Stack” being used and comparing it to other lenders.

Lender Profit Margins.

The average Mortgage Lender tries to make about 3% to 4% of the loan amount in profit. For a home that is $400,000 this can easily equal $12,000 to $16,000. This is a lot of money and lenders have been operating with this amount of cash per loan for along time. Most of the mortgage lenders you see in advertisements are making this much per loan.

There are “discount ” lenders around that make much less then that to do a loan. For Example Low Cost Mortgage https://www.lcmloans.com has a target gross margin of 1.25% which means a they can usually beat most of the other companies in rate because they are marking up the loan less. This is why it is important to pick up the phone can call several different companies for a direct cost comparison.

Pick up the phone and call.

Now that you know your Credit Score, and how mortgage companies make their money with the extra fees it is now time to pick up the phone and call a few mortgage lenders. When you call all you need to do is tell them what you are doing, what your credit score is and ask them what their rate is and what is the “cost of the rate”

Example: If you are buying a home and you are putting 5% down you will call a mortgage company and state the following.

Hi, I am buying a home in Colorado, It is $400,000, I am putting down 5%, my credit Score is 723. What is your interest rate and what is the total for Loan Origination, Loan Discounts, Processing and Underwriting fees for that rate?

Your intention is to write down the Interest Rate quoted, and the total of the costs of the rate. You do need to be specific with the Loan Officer you are talking to as most will not want to answer what the cost is for the rate or they will not think about the costs as they charge it on every loan.

Some simple rules to follow when calling the different lenders.

- If the company can not quote a rate over the phone by you telling them your credit score and the require you to fill out an application or pull your credit for a quote. DONT USE THEM

- Do not fill out an application yet, you are not at that point.

- Do not have them pull your credit. You have a score and that is good enough for them to quote a rate.

Compare your Rate Quotes.

Now that you have a list of lenders and they have given you a rate and a cost of the rate you need to compare.

The easiest way to compare is to take the 3 that have the lowest fees and have them all quote the same interest rate. You will call each one of them and ask them to tell you what the cost would be for X.XX% rate and write it down. The lowest cost for that rate is usually the best lender to use to save the most amount of money.